So, when you file for a tax refund or to debit a tax payment, you can use your routing number as a reference to support your tax procedures. Taxes are something that every company needs to deal with. You can use it to set up direct deposit or automatic online payments or in some cases even loan payments. Here's one situation where your routing number plays a pivotal role. In your business, you'll likely come across recurring payments, like bills, paychecks, social security, etc. No matter if your transactions are small or large, knowing what your routing number offers can be quite significant in various situations. This is because most routing numbers are public information that can be found on each bank's website.Įxamples of public Bank Routing Numbers from popular banks:Ī routing number is used for various purposes - like sending and receiving funds from wire transfers - but it's also great for many banking activities. Should You Keep Bank Routing Number Confidential?Ī routing number is not and does not need to be confidential. In cases where the wrong routing number was provided during the transfer, it can cause your transaction to be delayed, or denied, and if it was approved, it could be transferred to the wrong account.

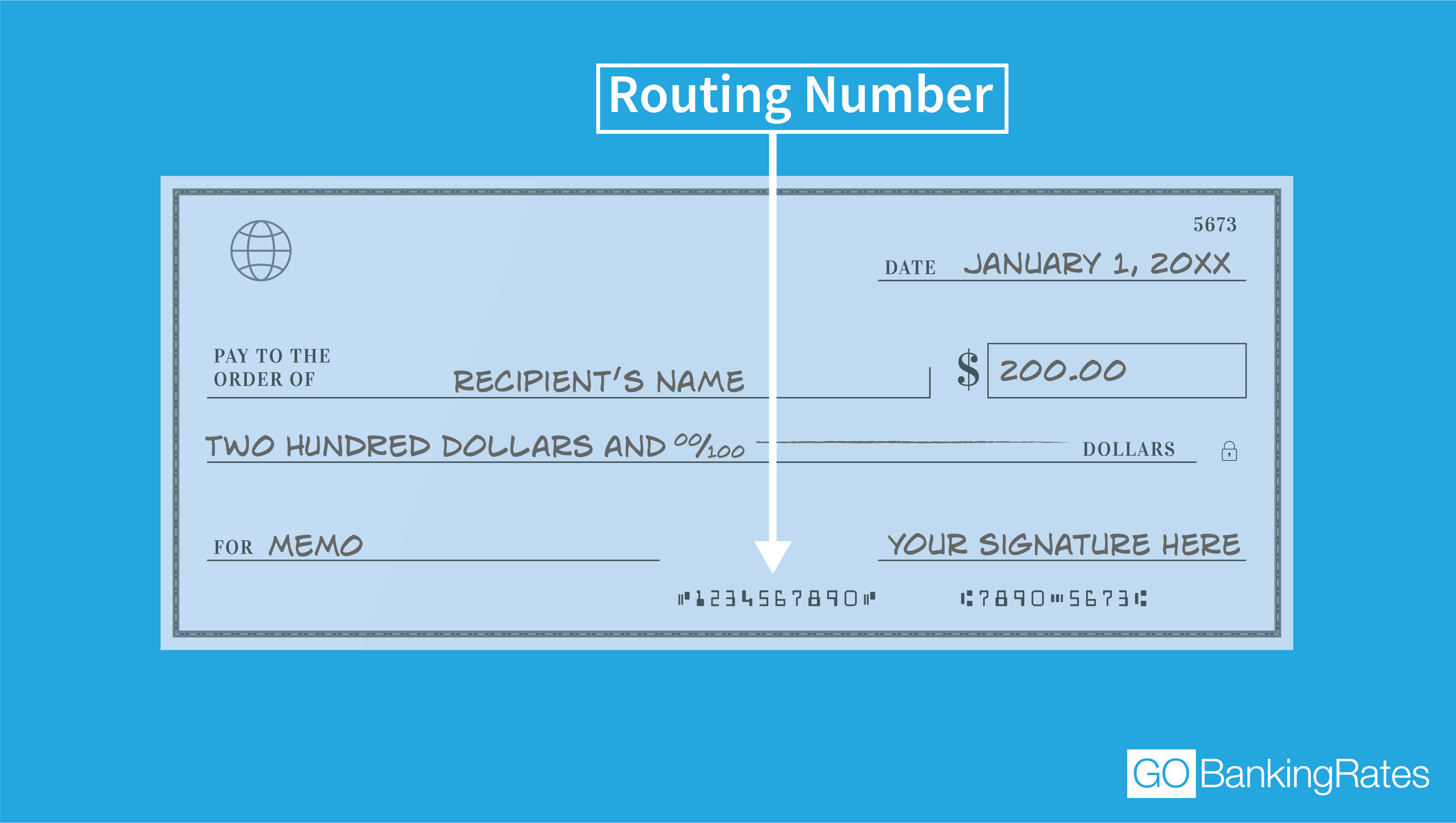

A routing number (also known as ABA which stands for American Bankers Association or RTN which stands for Routing Transit Number) is a nine-digit number that is used by banks or other financial institutions to identify where your account was opened in order to send or receive money.Įach bank will have its own specific routing number assigned to them to reduce the chances of miscommunication.

0 kommentar(er)

0 kommentar(er)